What is the impact of Myanmar coup on the rare earth industry?

According to Xinhua News Agency, in the early morning of February 1, local time, the political situation in Myanmar suddenly changed. President Win Myint, Counselor Aung San Suu Kyi and some senior officials of the National League for Democracy were detained by the military. On the 1st, the Myanmar military issued a statement saying that in accordance with the provisions of the constitution, it implemented a one-year state of emergency and announced a large-scale reorganization of the current government of Myanmar. The ministers of 11 central government departments in Myanmar were replaced, and 24 deputy ministers of 19 central government departments were removed from their posts. On the 2nd, the Myanmar military formed a national leadership committee and reorganized the election committee.

As the world's third largest producer of rare earths and my country's largest importer of rare earths, what impact might the political turmoil in Myanmar have on my country and the global rare earth industry?

01. Myanmar is the world's third largest producer of rare earths

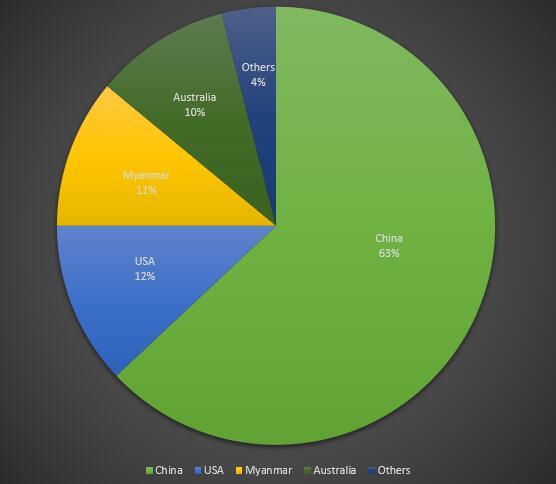

The global supply of rare earths is relatively concentrated, and

Myanmar is one of the production areas second only to China and the United

States. According to USGS preliminary statistics, in 2019, the global output of

rare earth mines was 210,000 tons, and China's output of rare earth mines was

132,000 tons, accounting for 63% of the global output; the United States,

Myanmar, and Australia accounted for 12%, 10.5%, and 10% respectively.

Considering the characteristics of Myanmar's local government and political

structure, rare earth mining activities in some regions may not be fully

counted.

Proportion of output in major rare earth producing countries in the world. Source: SMM, Essence Securities Research Center.

In addition, unlike the bastnaesium rare earth ore (mainly praseodymium and neodymium light rare earth) owned by the United States, Australia and other countries, Myanmar mainly produces ion-type rare earth ore (mainly medium and heavy rare earths such as dysprosium and terbium).

02. Myanmar is an important source of my country's imports of medium and heavy rare earths

According to customs data, my country's imports of rare earth ore from Myanmar accounted for 23% of the total import volume of rare earth ore. From 2018 to 2020, my country imported 25,800 tons, 12,900 tons, and 6,225 tons of mixed rare earth carbonate from Myanmar, and unlisted oxides were 8,147 tons, 14,427 tons, and 17,000 tons, respectively. From 2019 to 2020, my country's imports of rare earth mixed metals from Myanmar are 1,200 tons and 11,000 tons respectively.

Rare earth mines imported from Myanmar account for half of my

country's medium and heavy rare earth consumption. According to data from

Soochow Securities, the total investment volume of more than 20 domestic raw

ore separation plants in 2020 is 30,000 to 35,000 tons, of which the domestic

ionic rare earth ore (mainly medium and heavy rare earth) mining index is

19,150 tons, which is equivalent to Myanmar's imported mines account for half

of the supply of medium and heavy rare earth mines.

In recent years, factors such as customs closure and epidemic

have caused frequent fluctuations in the supply of rare earths in Myanmar. An

analyst from the rare earth sector of Shanghai Iron and Steel Union pointed out

that the reason for the decrease in Myanmar's rare earth exports in 2019 was

the customs closure, while in 2020 it was due to the impact of the epidemic and

the rainy season. In addition, the decline in grades of major mines in Myanmar

in the past five years has also affected rare earth exports. However, despite

the relevant policy constraints, the control of the mines in northern Myanmar

is still relatively lax, and the export of rare earth mines to my country has

not stopped.

03. Rare earth prices are closely related to Myanmar's supply

situation

According to historical experience, every time Myanmar mines

reduce production, stop production or export control, it will have a greater

impact on the supply of medium and heavy rare earths. According to data from

Essence Securities, due to the failure of normal customs clearance within a

short period of time after each customs closure, the price of rare earths in my

country will rise sharply. Since the first customs closure in 2018, the price

of dysprosium oxide, a representative of medium and heavy rare earths, has been

used as the observation target. It can be found that the price of rare earths

is very consistent with the time point of Myanmar's customs closure.

In 2018, affected by the sea closure, all resource-related commodities in Myanmar could not be imported into China, and then the domestic rare earth prices ushered in a rebound. The prices of medium and heavy rare earths, led by dysprosium oxide and terbium oxide, have experienced a large wave-like rise. Terbium oxide rose from a low of about 2900 yuan/kg to around 4200 yuan/kg, an increase of 45%; dysprosium oxide rose from about 1150 yuan/kg to a high around 2,000 yuan/kg, an increase of more than 70%.

Historical trend of rare earth prices

Source: Baichuan Information, Zhongtai Securities Research Institute

On February 1, in the latest listing price announced by Southern Rare Earths, the prices of heavy rare earths such as terbium oxide and dysprosium oxide continued to increase. The median price of terbium oxide was increased by 100,000 yuan/ton, and the median price of dysprosium oxide was increased by 35,000 yuan/ton. Ton.

04. The Myanmar incident exacerbated the potential supply risk of my country's medium and heavy rare earths

Although there are currently opinions that Myanmar's rare earth-producing mines are concentrated in northern Myanmar, Myanmar's military control has always been lax, the local political environment and regional conflicts are more complicated, and there are many factors affecting the supply of rare earths, but there has never been an absolute one. Blocked. An analyst from the rare earth sector of Shanghai Iron and Steel Union said that the current political change was led by the government army. Rare earth mines are mainly controlled by the local army. The government has less jurisdiction over rare earth mines. The current incident in Myanmar has little direct impact on the import and export of medium and heavy rare earth mines. The coup is expected to have no major impact on Myanmar's rare earth supply for the time being.

However, the Myanmar military announced a one-year state of emergency, which has caused extremely unstable emotional effects on foreign miners in Myanmar. It is expected that investment in Myanmar will shrink, and whether the military will follow up on blockade measures is yet to be known. If this political conflict intensifies, it will not rule out an impact on the supply of rare earths in the later period. If, due to political factors, the production of rare earth mines in Myanmar is reduced, halted, export controls or even exports are stopped, it will have a greater impact on the supply of medium and heavy rare earths in my country. In the medium and long term, there are certain potential risks in Myanmar's rare earth supply.

05. The global rare earth supply and demand pattern will continue to be tight

At present, the global rare earth supply and demand situation is tight. Data from Soochow Securities shows that since 2017, rare earth mines in the United States, Australia, Myanmar, and other countries have resumed production, and the global supply of rare earths has doubled in the past three years. However, due to production capacity constraints, it will be difficult for the world to add new production capacity in the next three to five years, and the supply of rare earths will be limited. In 2020, the total amount of domestic rare earth mining increased by 17% compared with 2018, the number of rare earth ore imported from Myanmar increased by 33% compared with 2018, and the number of rare earth ore imported from the United States increased by 160% compared with 2018.

Domestic rare earth supply is also subject to policy constraints. The Ministry of Industry and Information Technology issued the "Regulations on the Management of Rare Earths" on January 15, which clarified the penalties for the illegal mining of rare earths and the conditions for possible shutdown or prohibition of mining, which are more stringent than in previous years. Due to poor profitability in the past few years, some domestic rare earth companies have shut down and their production capacity has shrunk. At the same time, the industry has been in the destocking stage. At present, the inventories of both companies and distributors have historically been at a low level.

However, the demand for new energy vehicles, wind power and

other fields downstream of rare earths has continued to increase. In fact, with

the recovery of new energy vehicles, the price of rare earths has risen

sharply. Since March 2020, the price of neodymium praseodymium oxide has risen

from 268,000 yuan/ton to 458,000 yuan/ton, an increase of 71%. Although the

supply side has grown significantly in the past three years, the sharp rise in

rare earth prices reveals that the downstream demand growth rate is much higher

than the supply side growth. If the tension in Myanmar is not eased, rare earth

prices may usher in a new round of increases.

Overall, in the context of the continuous expansion of the

global rare earth supply gap, the political turmoil in Myanmar may exacerbate

this tension.

Source: Xinhua News Agency, Soochow Securities, Baichuan

Information, Zhongtai Securities Research Institute, Shanghai Nonferrous

Network, Essence Securities Research Center, Tonghuashun Finance, Financial

Association, Oriental Fortune, etc.